It’s been a notable year so far for leading nonwovens manufacturer Glatfelter, and the company will have plenty of new things to discuss with customers at INDEX™20 from 19-22 October 2021 in Geneva.

All systems go at Glatfelter

It’s been a notable year so far for leading nonwovens manufacturer Glatfelter, and the company will have plenty of new things to discuss with customers at INDEX™20 from 19-22 October 2021 in Geneva.

Georgia-Pacific

In January this year Glatfelter announced the purchase of Georgia-Pacific’s US nonwovens business for US$175 million, including its airlaid manufacturing business in Mount Holly, North Carolina, and its R&D pilot line for nonwovens product development in Memphis, Tennessee.

The Mount Holly facility has a capacity of 37,000 metric tons and produces high-quality airlaid products focused on wipes and tabletop materials. The R&D pilot line and additional technical resources will enhance ongoing innovation efforts. The deal follows Glatfelter’s 2018 acquisition of Georgia-Pacific’s European nonwovens business, which included a manufacturing plant in Steinfurt, Germany.

Jacob Holm

In July, Glatfelter subsequently announced the acquisition of Jacob Holm, the leading manufacturer of spunlace nonwoven fabrics, for approximately US$308 million.

This acquisition will increase Glatfelter’s diversification into attractive and complementary segments serving the growing wipes, healthcare and hygiene categories.

Jacob Holm has four manufacturing facilities and six sales offices located in the Americas, Europe, and Asia, and approximately 800 employees worldwide. Its broad product offerings and customer base will expand Glatfelter’s portfolio to include surgical drapes and gowns, wound care, facemasks, facial wipes and cosmetic masks.

The acquisition also includes Jacob Holm’s Sontara business – a leading brand of finished products for critical cleaning wipes and medical apparel.

Jacob Holm generated approximately $400 million in revenue and about $45 million in earnings in the year to June 30, 2021, supported by strong pandemic tailwinds.

Natural materials

Time is now needed for the synergies following these two major deals for the nonwovens industry to be realised, but in a recent seminar held by Nonwovens Industry magazine, Glatfelter executives provided an overview of the company’s recent achievements.

Senior vice president and chief commercial officer Chris Astley said that with $916 million in sales in 2020, 2,500 employees and 12 manufacturing facilities (prior to its latest acquisition), Glatfelter continues to build on a 150-year legacy, based on the development of products that are rooted in nature and engineered for performance.

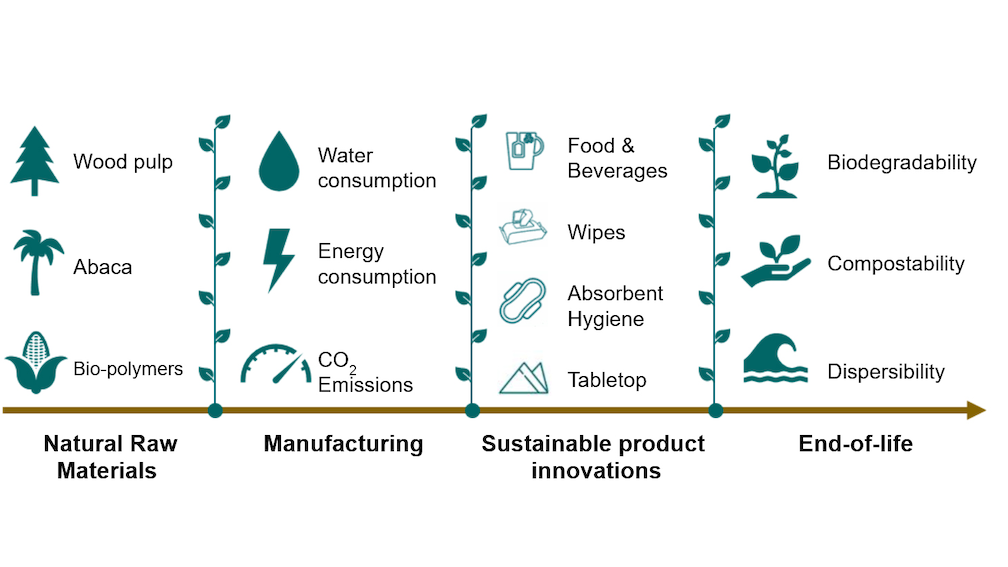

“Our portfolio is based on 100% natural materials and our manufacturing focus is constantly on preventing pollution,” he said. “We are continuously reducing our consumption of energy, water and CO2 emissions, even as our production is increasing.”

Pulp and abaca

Silke Brand-Kirsch, VP of marketing and business development, added that the company’s key raw materials are based on wood, abaca and biopolymers.

“In the paper industry, pulp from wood resources is processed very efficiently and some of the modern mills we rely on as suppliers, are now generating more energy than they use,” she said. “We have forestry certifications for all of the hardwood, softwood and fluff pulp we use, and in Europe, forests flourished and expanded by an area the size of Belgium between 2010 and 2020.”

Glatfelter also owns an abaca plantation in the Philippines which is organised in partnership with the Rainforest Alliance, and produces raw materials for the company’s tea and coffee filter papers.

“We also use PLA as a bonding fibre, which is manufactured with less energy and less greenhouse gas emissions compared to oil-based polymers,” Brand-Kirsch said. “We are exploring the use of other biopolymers and keep ourselves up to date in respect of new developments.”

Packaging

Vishal Bansal Galtfelter’s VP of innovation, provided details of new developments the company is working on across its extensive pilot processing and prototyping plants and chemistry labs.

Phyto, for example, is a new multi-layered wetlaid pulp product targeted at the heat sealing and multi-barrier food packaging markets, providing superior end-of-life options to current plastics.

Phyto is biodegradable and flexible, with three layers of plant-based coatings which provide excellent oxygen and moisture barrier, and also prevent aromas from escaping.

It can be heat sealed via a route comparable to polypropylene films and can also be recycled in paper streams.

Another new development is MAM – a wet pulp airlaid development aimed at the rigid packaging market. It is dry moulded with just heat and pressure and impregnated with resin for 3D structural applications, with a cellulosic content of over 80%.

Other work is also examining the replacement of synthetic fibres and latex in absorbent cores and ADLs with plant-based alternatives.

Wipes

Bansal said that the European Union’s Single-Use Plastics Directive had resulted in a major new need for sustainable and plastic-free substrates.

“We are already supplying substrates for moist toilet tissue and over 70% of the material we sell today is based on cellulosic fluff pulp, he said. “We are also involved in programmes to develop new binders that are plastics-free.

Justine Egret, Glatfelter’s global product section manager for consumer products added that the company made over 30 grades of nonwoven for wipes, all based on cellulosic fibres and wood pulp and either wetlaid or airlaid.

“Most of the nonwovens for wipes we are supplying in Europe do not have to carry the new plastics content labels,” she said.

This includes the new GlatClean substrates for disinfecting wipes substrates, which have a Quat release efficiency of up to 90%, based on specially-designed formulations.

In summary, Chris Astley said the emphasis in product development at Glatfelter would remain on materials that are dispersible, compostable or biodegradable.

“Petroleum-based materials will continue to have a role in many areas, but for single-use disposable products, the move to natural fibres and raw materials will continue to trend in this direction,” he said.