Like many other countries, India is currently witnessing an economic slowdown, but this is likely to be short-lived, with many factors suggesting a boom in the coming decade.

In a recent conference presentation, Kanav Gupta of BCH, the technical textiles and nonwovens consultancy, said that the prospects for the growth of nonwoven-based absorbent hygiene products (AHPs) were particularly robust.

The core consumers of AHPs – those in the high and upper middle classes – will expand by 51% to 197 million by 2030, while urban residents will grow to 40% of the country’s 1.3 billion population.

The growing working class too, will have more purchasing power to spend on consumer goods, while Millennials and GenX consumers will spend more than their predecessors and also be more brand aware.

Structural changes

“India’s government is bringing in structural changes laying a strong foundation for this growth by cutting corporate tax and introducing initiatives such as Make in India and the Smart Cities Mission, while encouraging more international collaborations,” Gupta said. “Better connectivity through infrastructure investment is increasing the distribution of AHPs, while the push for standardisation is leading to strong quality parameters being established.”

India now ranks second in terms of telecoms and internet subscriptions as well as app uploads, and by 2030 the internet will reach over a billion people.

“Very rapidly and subtly, the internet is increasing customer aspirations by exposing people to new products and living standards,” Gupta observed. “The need and momentum for solving problems is at an all-time high, as well as a growing awareness of health, hygiene and sustainability.”

The recently announced Open Defecation Free initiative, for example, will see the installation of a planned 100 million new toilets in India in the next five years, and while the government has backed away from an immediate nationwide ban on plastic bags, it is putting plans in place to fade them out in the next few years.

E-Commerce

Meanwhile, the Indian E-Commerce market with 100% foreign direct investment is growing at over 50% and it appears that India will leapfrog from largely traditional retail stores to it – bypassing the establishment of supermarkets and large retail outlets.

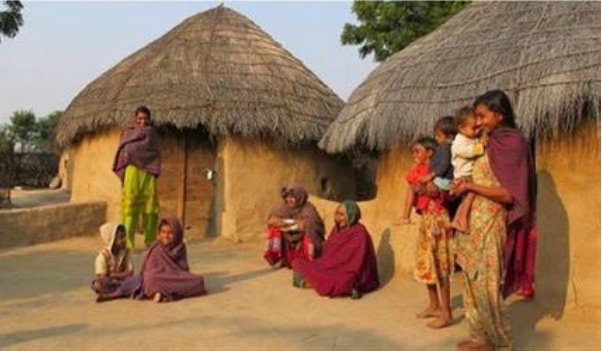

As far as AHPs are concerned, there is a huge disparity in growth between high performance states and those emerging more slowly, and market strategies need to be tailored accordingly, Gupta said.

“There are many segments within India and each requires a different product mix,” he said. “As an industry we need to know which segment we are targeting and what drives it, and design and deliver accordingly.”

Baby diapers

The current annual consumption of baby diapers in India is around 7.95 billion units, representing market penetration of just 15%. By 2023 it is expected to rise to 19.88 billion pieces, representing annual growth of 20% and reaching 35% penetration.

Around 90% of this market is for pant-type diapers and the trend for topsheet is to more cotton-like, soft and lofty materials.

Over 90% of the market currently belongs to the multi-national corporations, but 20 new Indian players have emerged with pant-like products over the past five years.

Major nonwoven investments for this market have included the first spunmelt line in the country for Japan’s Toray Industries and an airthrough bonding line for Taiwan’s Nan Liu, both of which will become operational in the next few years. Nobel Hygiene’s Teddyy diapers are so far the biggest home-grown brand.

Femcare

Market penetration for femcare products is higher, at 43.8% (from just 20% five years ago) and 17.2 billion units, with growth to 2023 of 18% to reach 39.4 billion units by 2023.

The multi-nationals also dominate in this market, led by Procter and Gamble and Johnson & Johnson, with Japan’s Unicharm seeing rapid growth. The share of imported sanitary napkins, however, is insignificant and volume growth is coming from rural areas for fluff-pulp based products, with ultrathin types increasing in popularity in urban areas.

AI products

Adult incontinence products, meanwhile, are used by just 1.1% of the potential market, with an annual 277 million units sold in 2018. Here growth is projected to be 22% annually, yet by 2023 will still only be 749 million units.

More than 60% of sales are currently institutional and no multi-nationals are currently marketing AI products, with the biggest domestic players being Nobel Hygiene and RGI Meditech.

Wipes

Of wipes sales in India, 75% are baby wipes, with the 97 million packs sold in 2018 set to grow by 20% to reach 241 million by 2023.

“Market piggybacking on baby diapers has really grown in the past five years, with J&J and Himalaya being the biggest players,” Gupta said. “The personal wipes sector is also seeing good growth and in hospitals, cotton towels are being replaced with nonwoven wet wipes.”

There is a healthy capacity for spunlace nonwovens in India, with Ginni Filaments, Mor Medics, Novel Tissues and Welspun all manufacturing for the wipes brands.

4 Is

Gupta concluded by citing his ‘4 Is’ – ignore, identify, innovate and invest.

“Ignore the trends in other markets and accept that India is different, diverse and complex,” he said. “Identify your choice of consumer segment and innovate for the Indian mindset in terms of needs and preferences. Finally, invest in quality for long-term success.”